The following is an excerpt from Zacks Chief Strategist John Blank’s full Apr Market Strategy report To access the full PDF, click here

I. Introduction

Welcome back to WWII-era geopolitics, folks!

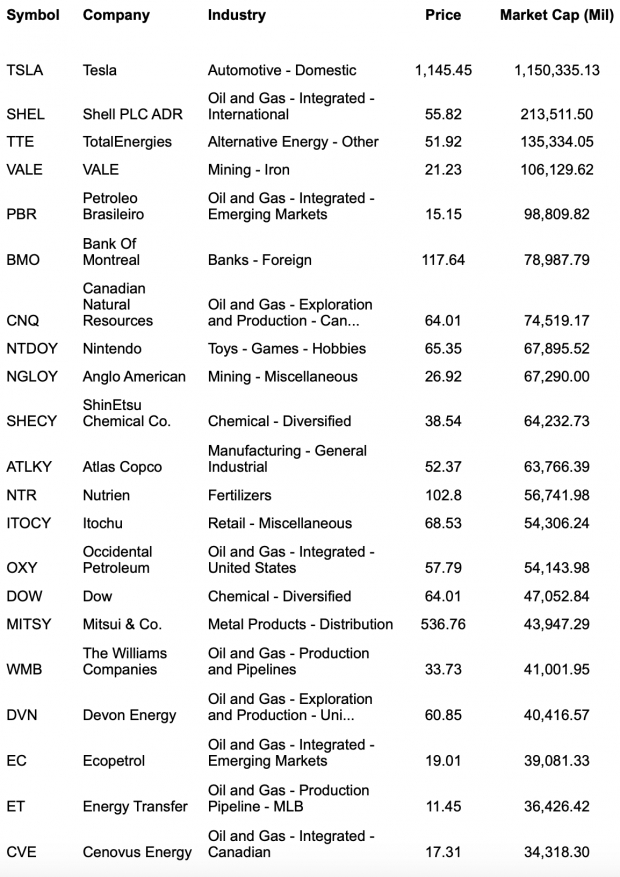

In order to assess Russia’s biggest influence on global markets, I pulled up and sorted out the 21 Largest by Market Cap -- Zacks #1 Rank (STRONG BUY) names in early April, 2022.

To no surprise, given the spike in oil and gas prices caused by Russia’s invasion of Ukraine, I found 14 of 21 of the Zacks #1 Rank large-cap companies located in the Oil and Gas (9), Mining (2), Chemical (2) and Fertilizer (1) industries.

Two thirds!

Confirm that below.

Top 21 by Market Cap Zacks #1 Rank (STRONG BUY) Stocks

II. What is my advice? Should you be playing these Oil and Gas names?

Image Source: Zacks Investment Research

Oftentimes, when there is a clean relation between a fundamental product’s price and a company’s earnings, the covering analysts can quickly re-set their annual earnings estimates upwards.

That is what happened here.

The other corollary idea I will present to you: This is an obvious set of covering analyst Oil and Gas related upgrades. These will be surely priced into stocks already.

In short, I would take those Zacks #1 Rank complex of Oil and Gas stocks with a grain of salt.

Furthermore, according to CNBC, the U.S. will release 1 million barrels of oil per day from its strategic reserves to help cut gas prices and fight inflation across the country, the White House announced on March 31st.

President Biden plans to tap the nation’s Strategic Petroleum Reserve for the next six months as domestic producers ramp up production, according to a fact sheet released by the Biden administration.

“The scale of this release is unprecedented: the world has never had a release of oil reserves at this 1 million per day rate for this length of time,” the White House said in a release. “This record release will provide a historic amount of supply to serve as bridge until the end of the year when domestic production ramps up.”

A senior administration official told reporters that, in combination with similar actions in other countries, the average daily amount released from global strategic reserves should exceed 1 million barrels.

The other idea I have for you is this: Yes, the massive and comprehensive sanctions on Russian oil and gas exports remain a major disruptive force. Yet there will be other major global oil and gas sources to tap, and unseen agreements made to access them.

Black-market alternative routes will be provided to Russian-sourced oil. Oil and Gas production and delivery remains a porous global market. And a rigged one.

III. Zacks April Sector/Industry/Company Telescope

Zacks Ranks showed 2 Very Attractive sectors: Energy and Industrials. These 2 gained significant strength from high oil prices and the supply crunches going on out there.

4 sectors (Info Tech, Financial, Materials, and Communication Services) looked Attractive. Both Info Tech and Financials took a breather, with lots of strength still. Materials got another noted upgrade. Steel is hot in that sector.

Consumer Discretionary stayed steady at Market Weight. Auto shortages help here.

Health Care was slightly softer, so I took it to Unattractive. Medical Care looked best. Less COVID cases mean lower backlogs and slightly less health care demand. Utilities fell to Unattractive, showing us this defensive is going to take a back seat soon.

Consumer Staples fell all the way back to Very Unattractive this month. Agri-business, with hot ag. commodity price hailing from Ukraine keeps this industry red hot. The other industry groups here suffer from a strong CPI, repressing consumer demand.

(1) Energy is likely the top sector and stays firmly at Very Attractive in April. Tops are Alternates, Oil E&P, Oil-Misc. and big Integrated firms. Pipelines look good too. Coal and Oil & Gas Drilling are just OK.

Zacks #1 Rank (STRONG BUY) Stock: Shell PLC SHEL

(2) Industrials rose to Very Attractive from Attractive. Metal Fabricating, Pollution Control (Biden infrastructure?), Conglomerates and Transport were the top industries.

Zacks #1 Rank (STRONG BUY) Stock: Reliance Steel & Aluminum RS

(3) Info Tech fell to Attractive from Very Attractive. Computer-Office Equipment and Semis (with a global supply shortage) stayed strong. Computer-Software Services fell.

Zacks #1 Rank (STRONG BUY) Stock: TDK TTDKY

(4) Financials fell to Attractive from Very Attractive. Banks & Thrifts, Insurance and Real Estate looked good. Higher rates ahead, the return to the office, and low unemployment rates helped out. Weak stocks took down Investment Funds and Investment Banking.

(5) Materials rose to Attractive from Market Weight. Steel, Containers & Glass and Metals - Non-Ferrous are the best niches to mine here.

(6) Communications Services rose to Attractive from Market Weight. Telco Equipment was the very strong industry factor.

(7) Consumer Discretionary stayed steady at Market Weight. Auto/Tires/Trucks are hot (no surprise). The Other Consumer Discretionary industry niche looks solid. There are lots of market weight industries here in April.

(8) Health Care slid a notch to Unattractive from Market Weight. Medical Care held best.

(9) Utilities fell to Unattractive from Market Weight. Utilities-Gas Distribution stayed the best.

(10) Consumer Staples fell all the way to Very Unattractive from Attractive. Agri-business (commodity prices) stand out. Downgrades to Food, Misc. Staples, Tobacco, and Soaps.

IV. Conclusion

Want to see a fresh, modestly bullish global macro-outlook? According to the latest from Canada’s BCA Research (whom I respect),

“Global growth will reaccelerate in the second half of this year provided a ceasefire in Ukraine is reached.”

“Inflation will temporarily come down as the dislocations caused by the war and the pandemic subside, before moving up again in late 2023.”

“Oil prices will dip in the second half of 2022 as the geopolitical premium in crude declines and more OPEC supply comes to market.”

Here at Zacks — where we model both WTI and Brent oil prices on a 12-15 month forward look — we see:

- WTI oil price consensus at $81.50 a barrel in June 2023, and

- Brent oil price consensus at $86.20 a barrel

Keep those fresh updated June 2023 forward oil price marks in mind traders!

That’s it for me.

Enjoy the latest Zacks April 2022 Market Strategy update.

Warm Regards,

Dr. John Blank,

Zacks Chief Equity Strategist and Economist

Image: Bigstock

Russia the Biggest Influence on Global Markets: Zacks APRIL 2022 Market Strategy

The following is an excerpt from Zacks Chief Strategist John Blank’s full Apr Market Strategy report To access the full PDF, click here

I. Introduction

Welcome back to WWII-era geopolitics, folks!

In order to assess Russia’s biggest influence on global markets, I pulled up and sorted out the 21 Largest by Market Cap -- Zacks #1 Rank (STRONG BUY) names in early April, 2022.

To no surprise, given the spike in oil and gas prices caused by Russia’s invasion of Ukraine, I found 14 of 21 of the Zacks #1 Rank large-cap companies located in the Oil and Gas (9), Mining (2), Chemical (2) and Fertilizer (1) industries.

Two thirds!

Confirm that below.

Top 21 by Market Cap Zacks #1 Rank (STRONG BUY) Stocks

II. What is my advice? Should you be playing these Oil and Gas names?

Image Source: Zacks Investment Research

Oftentimes, when there is a clean relation between a fundamental product’s price and a company’s earnings, the covering analysts can quickly re-set their annual earnings estimates upwards.

That is what happened here.

The other corollary idea I will present to you: This is an obvious set of covering analyst Oil and Gas related upgrades. These will be surely priced into stocks already.

In short, I would take those Zacks #1 Rank complex of Oil and Gas stocks with a grain of salt.

Furthermore, according to CNBC, the U.S. will release 1 million barrels of oil per day from its strategic reserves to help cut gas prices and fight inflation across the country, the White House announced on March 31st.

President Biden plans to tap the nation’s Strategic Petroleum Reserve for the next six months as domestic producers ramp up production, according to a fact sheet released by the Biden administration.

“The scale of this release is unprecedented: the world has never had a release of oil reserves at this 1 million per day rate for this length of time,” the White House said in a release. “This record release will provide a historic amount of supply to serve as bridge until the end of the year when domestic production ramps up.”

A senior administration official told reporters that, in combination with similar actions in other countries, the average daily amount released from global strategic reserves should exceed 1 million barrels.

The other idea I have for you is this: Yes, the massive and comprehensive sanctions on Russian oil and gas exports remain a major disruptive force. Yet there will be other major global oil and gas sources to tap, and unseen agreements made to access them.

Black-market alternative routes will be provided to Russian-sourced oil. Oil and Gas production and delivery remains a porous global market. And a rigged one.

III. Zacks April Sector/Industry/Company Telescope

Zacks Ranks showed 2 Very Attractive sectors: Energy and Industrials. These 2 gained significant strength from high oil prices and the supply crunches going on out there.

4 sectors (Info Tech, Financial, Materials, and Communication Services) looked Attractive. Both Info Tech and Financials took a breather, with lots of strength still. Materials got another noted upgrade. Steel is hot in that sector.

Consumer Discretionary stayed steady at Market Weight. Auto shortages help here.

Health Care was slightly softer, so I took it to Unattractive. Medical Care looked best. Less COVID cases mean lower backlogs and slightly less health care demand. Utilities fell to Unattractive, showing us this defensive is going to take a back seat soon.

Consumer Staples fell all the way back to Very Unattractive this month. Agri-business, with hot ag. commodity price hailing from Ukraine keeps this industry red hot. The other industry groups here suffer from a strong CPI, repressing consumer demand.

(1) Energy is likely the top sector and stays firmly at Very Attractive in April. Tops are Alternates, Oil E&P, Oil-Misc. and big Integrated firms. Pipelines look good too. Coal and Oil & Gas Drilling are just OK.

Zacks #1 Rank (STRONG BUY) Stock: Shell PLC SHEL

(2) Industrials rose to Very Attractive from Attractive. Metal Fabricating, Pollution Control (Biden infrastructure?), Conglomerates and Transport were the top industries.

Zacks #1 Rank (STRONG BUY) Stock: Reliance Steel & Aluminum RS

(3) Info Tech fell to Attractive from Very Attractive. Computer-Office Equipment and Semis (with a global supply shortage) stayed strong. Computer-Software Services fell.

Zacks #1 Rank (STRONG BUY) Stock: TDK TTDKY

(4) Financials fell to Attractive from Very Attractive. Banks & Thrifts, Insurance and Real Estate looked good. Higher rates ahead, the return to the office, and low unemployment rates helped out. Weak stocks took down Investment Funds and Investment Banking.

(5) Materials rose to Attractive from Market Weight. Steel, Containers & Glass and Metals - Non-Ferrous are the best niches to mine here.

(6) Communications Services rose to Attractive from Market Weight. Telco Equipment was the very strong industry factor.

(7) Consumer Discretionary stayed steady at Market Weight. Auto/Tires/Trucks are hot (no surprise). The Other Consumer Discretionary industry niche looks solid. There are lots of market weight industries here in April.

(8) Health Care slid a notch to Unattractive from Market Weight. Medical Care held best.

(9) Utilities fell to Unattractive from Market Weight. Utilities-Gas Distribution stayed the best.

(10) Consumer Staples fell all the way to Very Unattractive from Attractive. Agri-business (commodity prices) stand out. Downgrades to Food, Misc. Staples, Tobacco, and Soaps.

IV. Conclusion

Want to see a fresh, modestly bullish global macro-outlook? According to the latest from Canada’s BCA Research (whom I respect),

“Global growth will reaccelerate in the second half of this year provided a ceasefire in Ukraine is reached.”

“Inflation will temporarily come down as the dislocations caused by the war and the pandemic subside, before moving up again in late 2023.”

“Oil prices will dip in the second half of 2022 as the geopolitical premium in crude declines and more OPEC supply comes to market.”

Here at Zacks — where we model both WTI and Brent oil prices on a 12-15 month forward look — we see:

Keep those fresh updated June 2023 forward oil price marks in mind traders!

That’s it for me.

Enjoy the latest Zacks April 2022 Market Strategy update.

Warm Regards,

Dr. John Blank,

Zacks Chief Equity Strategist and Economist